DW Insurance

Posts by :

Medicare Open Enrollment 2020-2021

Medicare Open Enrollment is Oct 15 to Dec 7

For 2021 healthcare coverage, Medicare’s annual Open Enrollment period runs from October 15 to December 7, 2020.

During Medicare Open Enrollment, seniors can:

- Switch from Original Medicare to a Medicare Advantage plan

- Change from Medicare Advantage to Original Medicare

- Select a different Medicare Advantage plan

- Choose a different Medicare prescription drug plan

Why do seniors need to make changes to their Medicare plans?

Medicare health and drug plans can change each year: costs, coverage, and which providers and pharmacies are in-network.

That means the plan that covered everything your older adult needed this year might not have the same coverage next year.

This is especially true for Part D prescription drug plans.

When the plans change, this could result in significant increases in next year’s healthcare costs.

But often, changing to a different plan could get the coverage your older adult needs without increasing their premium or out-of-pocket costs.

And, there’s always the chance that a plan with a lower premium could provide the coverage they need.

The Annual Notice of Change letter highlights important changes

To find out what’s changing in your older adult’s current Medicare plans, look for the Annual Notice of Change (ANOC) letter.

The ANOC is a helpful summary that highlights any changes in coverage, costs, or service area that will be effective in January 2021.

Medicare plans send their ANOC letters in early October and Medicare Advantage plans typically send theirs in September.

Compare 4 important areas of Medicare coverage

1. Premiums

Is the plan premium going up? If the increase is significant, there might be a plan that gives similar coverage at a lower price.

2. Deductibles and co-pays

What are the current deductibles and co-pays? Will these be increasing next year?

3. Prescription drug coverage

Medication that’s not covered is expensive. Paying special attention to prescription drug plans could save a lot of money.

It’s time-consuming, but necessary to find out how changes in drug plan premiums, formulary, and pricing tiers will affect the cost of medications your older adult takes.

Typically, a plan could raise premiums, add or remove drugs from their formulary, change pricing, or move drugs from one price tier to another.

Look up each of your older adult’s medications so you’ll know:

- If it’s covered in the plan’s formulary

- Which pricing tier the medication is in

- How much the drugs in that tier will cost

It’s also important to know if your older adult’s preferred pharmacy is in the plan’s network (prices are lowest in-network) and if there are any restrictions, like prior authorization or being forced to try a certain drug first.

Estimating those costs and taking restrictions into account gives you a clear picture of which 2019 plan will provide the most cost-effective prescription drug coverage.

Note: A plan’s formulary is the list of covered medications. Most prescription drug plans have 5 pricing tiers – preferred generics, other generics, preferred branded drugs, other branded drugs, and expensive specialty medications. Each tier has a different cost.

4. Part C / Medicare Advantage / Managed Care

If your older adult has a Medicare Advantage plan, call their current doctors, hospitals, specialists, and other providers to make sure they’ll still be in the plan’s provider network in 2019.

Changes made during Open Enrollment will take effect on January 1, 2021. And after December 7th, no further changes to Medicare coverage can be made for 2021.

We explain why reviewing and making changes to your older adult’s medical and prescription plans can help them save money and improve next year’s coverage.

We also share how to know which plan changes to focus on, how to compare 4 key areas of coverage, and 4 ways to get help with Medicare decisions.

如何购买出租屋保险

#租房 #保险公司 #美国房产#保险

很多人在美国买房子, 但是自己又不住在里面,而是出租出去,从而赚租金。把房子做为一个投资的工具。 那做为房东来说, 购买出租房保险就非常的必要了。 以下我会介绍如何在美国买这类的保险

在美国, 保险公司有专门的保险给这类出租的房子,我们叫它做出租房保险(Landlord Insurance)。 这种保险跟我们自住房保险(Homeowner Insurance)是有区别的。 出租房保险的定义其实很简单:房子是房东的但是房客在住。错误的保单很可能会导致有理赔时,保险公司拒赔或者少赔。

所以大家千万不要买错。 那出租房到底包含些什么内容呢?

一、房子的重建费用 (Dwelling):

如果房子遭到什么自然灾害,保险公司会支付的重建房子的费用 。这一般是指房子结构上的费用。它也包括,花草树木,围墙、游泳池等等其他建筑。

二、租金损失 (Loss of Rent):

房子遭到灾害,比如火灾,房客不再租这房子,这导致房东的租金损失。在房子重建或者维修期间,保险公司会对于租金的赔偿。

三、责任险 (Liability):

这是一个非常重要的保障条款。除了房东和房客以外的人受伤了,这项责任险会做出相应的理赔。这一项也包含相关的法律费用,比如律师费用,辩护费用。

如何购买出租房保险呢?

一、计算出适合的重建费用

这就需要一个有经验的保险代理帮您计算出正确的房子承保费用。 大家要注意,这个重建费用跟购买房子的费用是不一样的。

二、选择合适的出租房保险种类

出租房种类有好几种。最常见的是DP1 和DP3。 DP1的保险是出租房的最基本险,它的费用低,但是房东要承受的责任也是最大, 如有损失,理赔金额是前扣掉折扣后,再赔给房东。您可以这样算: 保险公司赔付金额 – 自付额 – 折旧额= 房东最后所得金额。

DP3: 它跟DP1的保险比较,它的保险范围就多很多。最主要是理赔时,不会扣折旧。

三、选择合适的责任险

上面我也提过, 在美国,责任险非常重要, 尽可能把它提高。 一般保险公司默认的金额是10万美金,但是您可以要求增加到更高。

四、选择合适的租金损失

如果是因为房子的原因,不能住人,而导致房东的损失,保险公司会赔。

五、选择合适的自付额

比如说是1万元的屋顶理赔, 房东的自付额是2000,那房东要先付2000元, 保险公司付剩下的8000元。自付额越高,相对的保费越低。

如有问题, 请随时联系我们经验丰富的保险代理。DW Insurance & Financial Services Inc.

了解出租房的保险

在美国,很多人都喜欢买房子, 更多的人想要做房东, 每个月能收租金。 根据统计,每80秒市场上就会有多一间出租房。 当这出租房的数量越来越多的时间,相对的问题也就出来了。 做为房东, 你的责任不再是只要寻找一个好的房客, 你还有责任去管理和维护这个房子。 比如说,如果房子被冰雹打到,或者被人恶意破坏, 又或者有人在我们房子范围内受伤了,作为房东,需要怎么办? 为了避免真的出现这种情况,房东不需要为了支付昂贵的费用而烦恼,那房东就需要买一份出租房的保险了(landlord insurance policy)。

出租房保险保些什么?

不同的保单所保的内容不太一样,但是大部分的是保以下三个部分:

-

财产损失保险:

出租房的保险基本上有保如果是火,天气或者犯罪活动所造成的损失。如果你买的是更好的保单,这份保单还会保车库,工具,围墙等等。

-

责任险:

如果有人在房子范围内受伤,这个责任险会保那受伤人的医疗费用,法律或者律师的费用

-

租金的损失:

如果房子有损失,而且是在保的范围内, 比如说火灾或者龙卷风, 房子不能住人的情况下, 房东所损失的租金, 大部分的保险公司会赔偿部分的租金损失。

出租房保险不保什么?

- 房客的物品不是在出租房的保险范围内的。 比如说因为火灾, 房客的汽车, 电脑,沙发和其他的个人东西都被火烧掉了, 房东的出租房保险是不赔这个的。 所以房东应该尽量的建议房客自己买一个房客的保险 (Renters Insurance) 去保他们自己的财物。

- 出租房保险不保维修。如果洗碗机坏了,或者热水器坏了,那是房东自己的责任。

理解保险里的自付额

当你自己了解保险的自付额,你可以避免一些意外的费用和省钱。

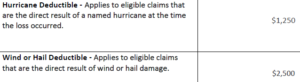

什么是自付额(deductible)

自付额的意思是当我们有保险理赔时我们自己要承担的费用。比如当我们家被冰雹打到,或者发生汽车事故,保险公司付的费用里, 这个自付额会自动的从这个费用里先扣掉的。

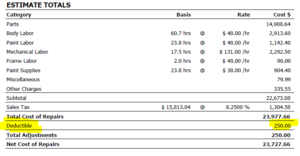

以下的是保险公司给出的汽车的修理估价,大家可以看到,$250的自付额就包括在这个估价里。 保险公司给出的支票只会是$23727.66, 而不是$23977.66。

自付额其实就是一种让客人跟保险公司分摊风险的做法。 一般来说, 自付额越高,相应的保险费用会越低。

自付额可以是一个指定的金额或者是保险单里一项的百分比。 这个是要看保险公司的做法。这个自付额内容一般在保单(declaration page)里可以找得到。

自付额是如何运作的

如果是指定的金额, 这个金额 会自动的从你的赔款里扣除。比如你的保单的自付额是$500, 你们保险公司确定这次理赔要花$10,000, 那你将会拿到的支票只有 $9500。

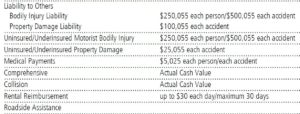

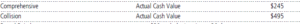

汽车的自付额:

其中一种房子的自付额表示方式:

另一种的表示方式:

百分比的自付额一般是出现在房子保单里。 它是根据你保单里的房子价值的百分比来算的。 比如说你的房子保$100,000 (Dwelling A), 而你的自付额是1%, 那你的自付额就是$1000。 所以如果我们有冰雹的理赔, 修整个屋顶要花$10,000, 那最后拿到的理赔支票只有$9,000。注:在这里我没有算上折扣。这方面的内容在以后再跟大家说清楚。

大家要特别注意的是, 在汽车和房子保险里, 自付额是按每次事故来算的, 这个不能说像医疗保险那样,一年内可以累计的。 所以大家要特别的注意和分别清楚。 但是也有特别的州对于某各特别的天灾会有特别的自付额。这个要看你所在州了。

而且这个自付额一般是针对“物品”,如果有责任险的理赔,这个就没有自付额了。 比如说因为交通事故而造成对方的身体伤害或者汽车的损失,这种情况下,保险公司会赔给对方,而不会向我们要求拿自付额。

提高自付额来省保费:

提高自付额是其中一种省保费的方法。 所以下次你在买保险时, 可以问问看如果把自付额变高些,你可以算多少,这样来做决定。 比如在汽车保险里, 当你把自付额从$250 升到$500, 你的保费会降些, 如果是升到$1000,那保费会降得更多。

但是,请大家要记住,在有理赔的情况下, 你要先付了自付额后, 保险公司才会付差额,所以不要捡了芝麻掉了西瓜。

房子保险里对于水的保障

大家在买房子保险的时候,很多人都会没有注意到些比较主要的保障,比如 “水“的保障(water coverage)就是其中一种。 虽然很多保险代理都跟你说你的保单里有保”水“,但是这个”水“的保障通常是一种误解。 最后,当客人需要报理赔时才发现其实保险不赔这项。 所以这里就跟大家说明一下不同种类的”水“的损失,这样大家在买房子保险时就会更清楚些。

洪水(FLOOD)

每个保险公司在它们的保单里都会特别的注明洪水是不在它们的保障范围里面的。 在保险里的洪水的定义是水从房子外面淹里面的水。 这种水造成的损失是不赔的。 但是,我们也不需要太担心这个。 因为我们可以单独的买这个洪水保障。这种洪水保险一般是由政府机构提供的。如果你住在洪水区,或者地势比较低的地址,购买洪水保险是一个很明智的决定。

在我们德州最近就有一个关于洪水的重大损失。 在2017年9月份,飓风哈维(Hurricane Harvey)就对我们德州造成了$1500-$1800亿美元的损失。其中有很大部分的房主就没有买洪水保险,最后,他们就要为自己的决定付出沉痛的代价。

突然或者事故性的漏水或者水举出(SUDDENT AND ACCIDENT DISCHARGE OR OVERFLOW OF WATER)

漏水原因和你所买的保险类型是很主要的。 大部分的自住房保险(homeowner policy)对这个类的漏水是有保障的。 意思是说,如果家里的热水器漏水,把家里的墙弄坏了, 你所买的保险应该会赔,除非是你的保险代理做错了些什么,比如说你应该买的是自住房保险,但是代理却帮你买的是出租房的保险,这明显是错的保单。所以保险公司可以不赔。

缓慢的漏水(SLOW AND CONTINUOUS LEAKS)

另一种大家会误会的漏水是“缓慢的漏水“。大部分的保单里都不会赔这种”缓慢“的漏水。有些公司也会提供些额外的保障来让客人自己选择加不加这个保障。

水管堵塞 (WATER BACKUP)

如果我们的下水道堵塞,导致水出不去而倒流回来所造成的损失。这个损失一般有它的金额限制,大部分是$5000。

地基水管的损失 (FOUNDATION WATER DAMAGE)

这是最后一项的水的损失。但是很多人看到这个一项时会以为是保房子的地基,因为他们看到这个英文Foundation(地基的意思),以为加了这一项,就可以保他们家的地基。这是一个错误的理解。在德州的保险里, 地基是不在保障范围内的。 一般的保险是不赔地板以下的水的损失。意思是说,如果这个水是同地下出来的, 保险是不赔这一项的。 除非你的保险里有特别的加上这个保障 (Foundation Water damage coverage)。这个保障是赔由地基里的水管破裂而造成的相关损失,比如找破裂水管的费用 ,撬开地板的费用等等。而不是赔这个水管。

什么东西都有它的寿命,地下的水管也是一样。这类的损失大多数发生在比较老的房子,如果你的房子比较老, 我建议你加上这个它。 这类的修理费用可以从几千到几万。

以上几点基本上是你能碰到的有关“水“的损失。 大家一定要记住,洪水的保险是要特别的购买。跟你平时买的房子保险是不一样的。 一般是政府提供的保障。但是其他的几点就要看你买的保险公司了。有些公司会提供漏水,有些会公司就没有。 所以,下次你在买房子保险时,问清楚你的代理那几类的”水“的损失这份保单是包括和不包括。 因为你不想等到事情发生的时候才发现你的保单是没有这项保障的。

美国汽车保险知识

在美国生活,平时都需要用车,这样就需要一个好的汽车保险来保护我们自己,以防真的出车祸时, 我们不需要承担庞大的赔偿金, 昂贵的医药费, 所以大多数州的法律都强制车主买保险。在被警察拦下时或者每年交牌照税或者做车检时,也会被要求出示汽车保险证明。

一、美国车险种类和具体定义

1、责任险 (包括二部分)

A. 人身伤害责任险「Bodily Injury Liability」

B. 财产损害保险「Property Damage Liability」

2、医疗费用保险「Medical Payments/Personal Injury Protection(PIP)」

3、碰撞险「Collision」

4、综合意外险「Comprehensive」

5、无保险或保险不足驾驶人保险「Uninsured and Underinsured Motorists Coverage」

若是很不幸,你驾车在路上被一辆“裸奔”(无车险)的车辆撞了,或者是对方司机保险额度不够赔付你和车上乘客的损失,又或者肇事逃跑〈hit-and-run〉等情况下, 如果事故责任方是对方,那么这项车险条款就会赔偿你的损失。

在有些州,这项保险是强制性购买的。好处是保费低廉。因为肇事对方可能无保险或保险额不足的缘故,所以这项保险是非常需要的。

其他方面的保障:

6、路上救援 「Emergency Road Service」

这项车险条款赔付的是,在行驶途中,车坏了,需要找人维修、拖车,或是把自己所在车外,需要叫人来开锁等,所产生的费用。

7、租车补偿「Rental reimbursement Coverage」

这项车险条款赔付的是,你自己的车辆因事故导致维修不能使用时,租车所产生的费用。

8、车玻璃补偿「Glass coverage」

这项车队条款赔付的是付给自己汽车的玻璃损伤的费用。

二、为什么我的全险不赔?

如果你的保险有包括基本责任险, 碰撞险和综合意外险就可以算是全险了。 但是这个全险是比较基本的,并不是真正的能给你全方面的保障。 其中像“对方没有保险(Hit & Run)”,“路上救援”,“租车补偿”等等就需要额外的加上才会有相应的保障。

所以大家在买车保时, 请特别要注意你买到的是什么保障,不要只是看价格。 每个人的情况不一样, 在买保险时,多花点时间跟你的代理谈谈,看哪些项目你是需要或者不需要,之后再做决定。 这样会大大的避免真的要理赔时而没有得到理赔的情况发生。

三、开车没保险可以吗?

无论如何,无车险驾驶不仅对自己的人身安全没有保障,一旦出了事故,车险保费大涨,医疗费用,汽车事故费用,都是一个个天文数字,还要面临各种罚款和赔偿等,更严重的是法律问题 (很可能被抓进监狱里待上一段时间)。所以,买了爱车,怎么能不买车险呢?

三、 车险保费及影响因素

美国车险通常都是半年一保,有些公司也提供一年。车险保费价格差距很大,有半年200多美金的,有半年500多美金的,也有半年1000多美金的。决定车险保费价格的因素很多,以下是些常见的因素:

- 车险种类:全险还是半险;

- 事故记录:事故越多,保费越高;

- 驾龄:无事故,驾龄越长,保费越低;

- 自付额 (Deductible)高低:自付额越高,保费越低;

- 年龄:25岁以下的人保费会高很多,因为这个群体不靠谱因素很多,25岁以上的人保费会相对低一些。

- 婚姻状况:结婚的人,保费会降低,因为结了婚,有了孩子,开车相对稳重许多;

- 地域:交通治安好的地区,事故率越小,保费相对较低;农村保费比城市低;

- 车型种类:豪车保费比平民车高很多

- 车辆每日行驶里程数和年度行驶里程数:行驶里程数越大,保费自然越贵。

四、美国车险是跟人走还是跟车走?

有人会问,美国车险是跟人走还是跟车走?普遍来说,美国车险是跟车走。但是,这也取决于不同汽车保险公司的条款规定。有些车险公司条款规定车险跟车走。

最后,我们要牢记,在美国拥有良好的驾驶记录益处多多,可以帮自己省下不少保费哦。不过,人身安全保障为大,切记不能无车险驾驶。

五、发生事故时要怎样处理?

1. 请先确认自己的车是否停在安全的地方,以避免再次发生事故。

2. 确定自己或乘客有无受伤。如有受伤,请马上请人打 911 求救。

3. 寻找目击证人,并询问是否愿意作证,并记录对方的联络资料。

4. 和事故对方交换驾照及保险资料,请先不要追论责任的归属。除非是双方想私下和解的小事故,请不要向对方道歉或提出赔偿要求,以免将来面对巨额索赔。

5. 向警察索取警察报告号码,警察报告通常会在事故发生后数天或数周后出炉,请仔细检查报告上的内容,如有错误,请写报告的警察马上更正。

6. 请马上向投保的保险公司报告事故发生的经过及地点,并提供对方的资料。

7. 收集及整理和事故有关的任何资料,如通话内容,通话人的姓名、电话、时间等资料,以便将来面对法律诉讼时,可以提供资料。

8. 如果您感受到自己的权益受到侵犯时,应先找法律谘询,以确保自己的权益不受到影响。

Recent Comments